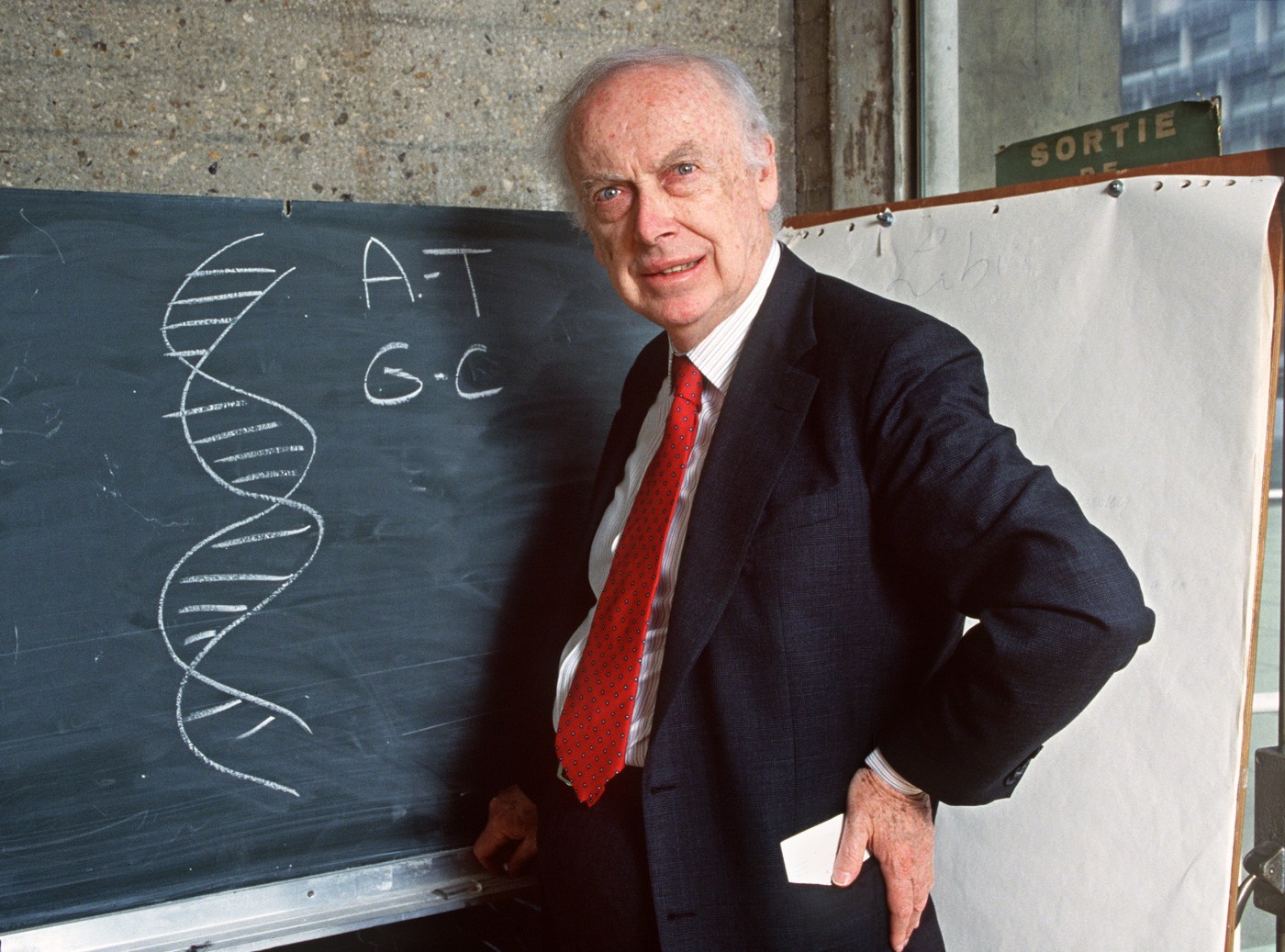

The news of Dharmendra’s death has not only left a deep void for his fans, but it has also brought an abrupt end to one of Bollywood’s most nostalgic projects. Director Anil Sharma has confirmed that Apne 2 a film meant to unite three generations of the Deol family will now never be made. Dharmendra, 89, died on November 24 after battling prolonged illness. He had been discharged from Mumbai’s Breach Candy Hospital just days earlier and was being monitored at home when his condition worsened. Anil Sharma, who had been preparing to direct Apne 2, admitted that the film cannot go ahead now. Speaking to Hindustan Times, he said, “Apne to apno ke bina nahi ho sakti. Without Dharamji, it’s impossible to make the sequel. Everything was on track and the script was ready, but he left us. Some dreams remain unfulfilled. Without him, it’s not possible!”The sequel was planned as a continuation of the 2007 family drama Apne, with Dharmendra, Sunny Deol, Bobby Deol and Karan Deol leading the narrative. Despite being announced years ago, the film never began shooting. Sharma and Dharmendra shared a working relationship spanning multiple films, including Hukumat, Elaan-E-Jung, Farishtay, Tahalka, and Apne. Their reunion with Apne 2 was meant to be another emotional chapter in their partnership one that now remains unfinished. Dharmendra’s last film to release will now be Ikkis, directed by Sriram Raghavan and starring Agastya Nanda. The film arrives in cinemas on December 25, 2025, exactly a month after the actor’s passing. On Monday, the makers shared a tribute poster and wrote, “Fathers raise sons. Legends raise nations. Dharmendra ji, an emotional powerhouse as the father of a 21-year-old immortal soldier. One timeless legend brings us the story of another.”Prime Minister Narendra Modi on Monday condoled the veteran actor’s death, calling his passing “the end of an era in Indian cinema.” In a post on X, the Prime Minister described the legendary star as an iconic figure whose versatility and screen presence left a deep imprint on generations of filmgoers. He said Dharmendra brought “charm and depth” to every role, making him one of the most beloved actors in Indian film history.