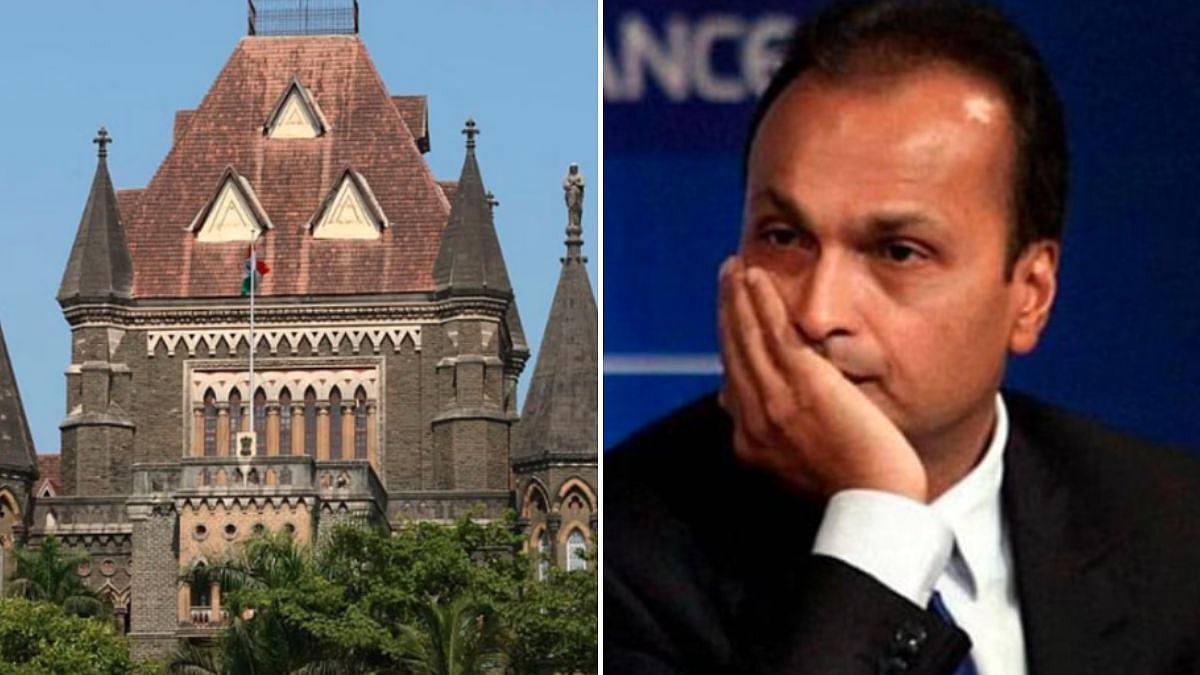

Bombay High Court Dismisses Anil Ambani’s Plea Challenging SBI’s “Fraudulent” Loan Account Classification

Mumbai: In a major setback to industrialist Anil Ambani, the Bombay High Court on Friday dismissed his plea challenging the State Bank of India’s (SBI) decision to classify his loan account as “fraudulent.” The account in question pertains to his firm, Reliance Communications (RCom), which is already undergoing insolvency proceedings.

Bench Statement

A bench comprising Justices Revati Mohite Dere and Neela K Gokhale rejected Ambani’s petition, stating: “There is no merit in the petition. Petition is dismissed.”

SBI and RBI Guidelines

SBI issued the order in June this year, following a Reserve Bank of India (RBI) master circular that allows banks to classify any account as fraudulent and provides guidelines for the process. This directive on fraud risk management was part of the RBI’s (Frauds Classification and Reporting by Commercial Banks and Select FIs) Directions, 2016.

The RBI further mandates that banks establish their own policies aligned with these directions. The master circular permits banks to fully utilize the Central Fraud Registry to ensure prompt identification, monitoring, reporting, control, and mitigation of fraud-related risks.

Once an account is designated as fraudulent, the bank must report it to the Central Repository of Information on Large Credits platform to alert other banks. Additionally, if a bank directly classifies an account as fraudulent, it is required to inform the RBI within 21 days and report the matter to an appropriate investigating agency.

Allegations of Misappropriation

According to SBI, Ambani misappropriated funds by engaging in transactions that violated loan terms, causing a loss exceeding Rs 2,929 crore. Following the bank’s complaint, the Central Bureau of Investigation (CBI) conducted searches at RCom’s premises as well as Ambani’s residence.

In August, the CBI registered a case against Ambani and his company for alleged bank fraud based on SBI’s complaint.

Arguments and Representation

During the hearing, senior advocates Darius Khambata and Prateek Seksaria, representing Ambani, argued that SBI acted arbitrarily and failed to follow due process when declaring the account fraudulent. They contended that such classification could severely impact Ambani’s ability to access banking facilities in the future.

However, SBI’s counsel, senior advocate Aspi Chinoy, defended the bank’s order, asserting it was issued in strict compliance with RBI directions.

Other Banks’ Actions

Meanwhile, several other nationalised banks have issued similar orders against Ambani’s loan accounts related to RCom.

In July, Canara Bank informed the High Court that it had withdrawn its earlier order classifying Ambani’s RCom account as fraudulent. Last month, the court restrained Bank of Baroda from taking coercive actions against Ambani, granting him temporary relief.

Ambani’s Response

A spokesperson for Anil Ambani stated, “We are awaiting the order. Once we have reviewed it, we will evaluate the next course of action, as legally advised.”

For details on exclusive and budget-friendly property deals in Mumbai and surrounding regions, please visit: https://budgetproperties.in/