Market Rotation Alert: Institutions Shift from Blue-Chips to AI Presales Like IPO Genie

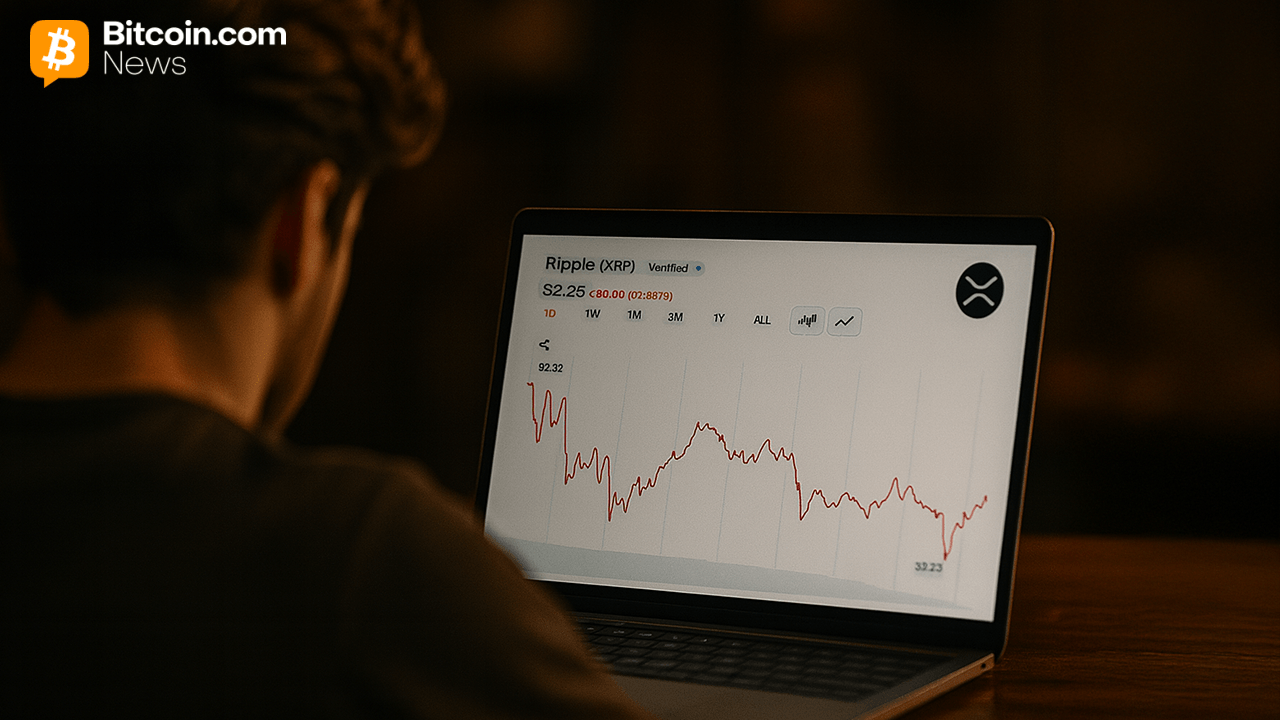

The post Market Rotation Alert: Institutions Shift from Blue-Chips to AI Presales Like IPO Genie appeared com. Crypto Presales A clear look at why big investors move from blue-chip coins to AI presales like IPO Genie and what this crypto market rotation means. What This Crypto Market Rotation Really Means Big investors are changing how they invest. This move is called crypto market rotation. It shows how money flows from one group of coins to another. For a while, these investors placed most funds in safe, trusted coins like Bitcoin and Ethereum. These coins are old, stable and known as blue-chip cryptos. Now the flow is shifting. These large buyers are moving early funds into AI presales. One project that stands out in this shift is IPO Genie PO. This article explains why this change is happening, how it works, and why many investors now link IPO Genie to the Top crypto presale 2025 lists. You will see how AI helps users understand trends, how blockchain keeps records open, and how early access gives a clean start for new users. We also talk about the IPO Genie Airdrop, which gives $50,000 to 40 winners. We begin with one simple question. Why would big investors move away from trusted coins? Why Crypto Market Rotation Happens Today Signs That Show the Trend Crypto market rotation happens when buyers want new chances. It can also start when old coins grow slowly. Many large buyers feel slow gains in blue-chip coins today. They want new ideas and faster paths. AI projects offer this. They offer new tools and early prices. Here are clear signs that crypto market rotation is starting: Buyers shift money into new sectors Volume grows in early presales Large wallets move before retail AI projects rise faster than most sectors These signs show why AI is now in focus. They also explain why people search for the Top.