**Blockchain.com Secures MiCA License in Malta, Marks Major EU Expansion**

Blockchain.com has recently obtained a MiCA license in Malta, a significant milestone in its efforts to expand into the European market. This license enables the company to offer its crypto services across the entire European Union (EU), tapping into the 27-country bloc through Malta’s regulatory framework.

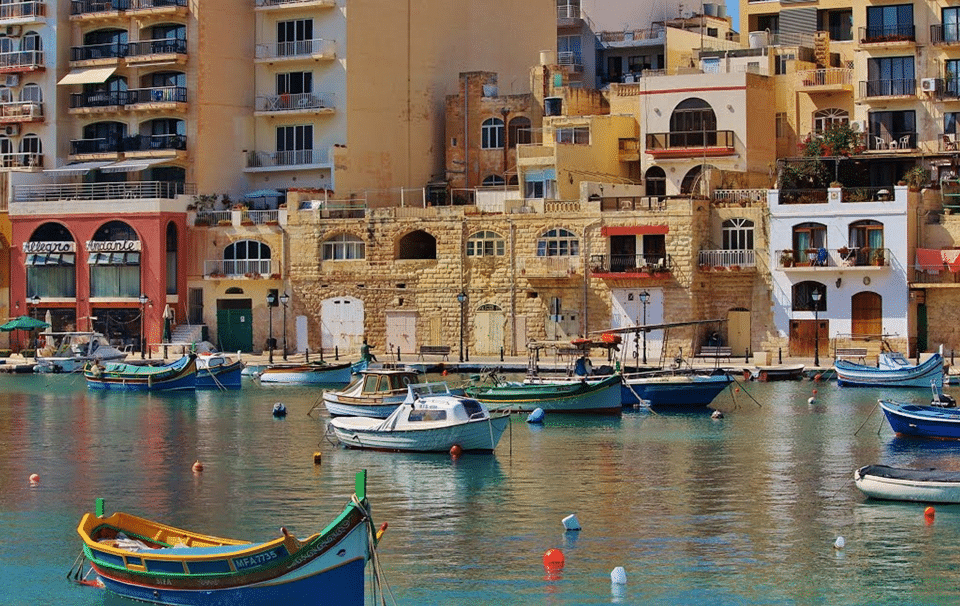

**Why Malta?**

A spokesperson from Blockchain.com explained that Malta’s regulatory environment provides the “right combination of transparency, institutional expertise, and strategic access.” This makes Malta an attractive hub for crypto companies seeking to operate throughout Europe.

With the MiCA license now serving as the foundation for its European operations, Blockchain.com joins other notable crypto firms such as Kraken, Gate, and Gemini in leveraging Malta as a gateway to the EU market.

Leading Blockchain.com’s EU strategy from Malta will be Fiorentina D’Amore, who is tasked with positioning the company for growth and navigating the evolving regulatory landscape.

**Understanding MiCA Regulation**

The Markets in Crypto-Assets (MiCA) regulation came into full effect in late 2024. This framework allows crypto businesses to obtain authorization in one EU member state and operate seamlessly across all member countries.

Blockchain.com plans to expand its services beyond centralized exchanges, focusing on brokerage, institutional infrastructure, and self-custody wallet solutions. The company is also closely monitoring regulatory developments in other key regions, including the UK, Singapore, Latin America, and the Middle East.

Although there has been speculation about a potential U.S. public listing, Blockchain.com has not officially commented on this but remains open to such opportunities in the future.

**Concerns Among EU Regulators**

Malta’s relatively light regulatory approach toward crypto has drawn scrutiny from various European authorities. In mid-September, regulators from France, Austria, and Italy called for stronger and more centralized oversight of the crypto sector within the EU.

They advocate for increased involvement by the European Securities and Markets Authority (ESMA) to supervise crypto markets across member states more effectively.

A recent ESMA review raised flags about Malta’s licensing practices, suggesting some risks were not fully evaluated during the authorization processes. Although the Malta Financial Services Authority (MFSA) demonstrated good cooperation, certain areas remain concerning.

Critics also point to Malta’s history, including its issuance of “golden passports” and lenient gambling regulations, as factors that may attract companies seeking more relaxed regulatory conditions.

The European Banking Authority (EBA) has warned against “forum shopping,” a practice where companies select jurisdictions like Malta with softer regulations. This can potentially undermine the integrity of the EU’s financial system and complicate investor protection efforts.

**Balancing Regulatory Diversity**

Despite these concerns, some legal experts argue that variations in national regulatory approaches are inevitable within the EU single market.

Dr. Hendrik Müller-Lankow, a lawyer with Kronsteyn, observes that differing national strategies reflect the ongoing balance between EU-wide integration and individual member states’ discretion. While some view such differences as a natural adaptation to EU laws, others perceive them as regulatory arbitrage.

**Conclusion**

Blockchain.com’s acquisition of the MiCA license in Malta marks a significant step in its European expansion, offering new opportunities and challenges. As the regulatory landscape continues to evolve, the company and regulators alike will need to navigate this complex environment to support innovation while ensuring market stability and investor protection.

https://coincentral.com/blockchain-com-gains-mica-license-in-malta-as-eu-supervision-concerns-rise/